A perspective on Venezuela's Extra Heavy and Bitumen hydrocarbons reserves

By Carlos Rodriguez

13.06.05 | View this paper in PDF format here. After almost two decades of successful development and marketing of the new and unique Venezuelan fuel for the power industry, the future of Orimulsion is unclear. PDVSA decided in August 2003 that it was dissolving Bitumenes Orinoco S.A. (BITOR) into PDVSA’s eastern operating division and not expanding production of Orimulsion because it could make more profits from Venezuelan extra-heavy oil and bitumen selling blends or syncrude instead of Orimulsion.

ORIMULSION IS THE BEST WAY TO MONETISE THE ORINOCO´S BITUMEN

After almost two decades of successful development and marketing of the new and unique Venezuelan fuel for the power industry, the future of Orimulsion is unclear. PDVSA decided in August 2003 that it was dissolving Bitumenes Orinoco S.A. (BITOR) into PDVSA’s eastern operating division and not expanding production of Orimulsion because it could make more profits from Venezuelan extra-heavy oil and bitumen selling blends or syncrude instead of Orimulsion.

PDVSA also announced that even that it intended to fulfil long-term contracts which BITOR had with utilities in Canada, Denmark, Italy and Japan, would not sign more new Orimulsion contracts or respect contracts under negotiation in Canada, Singapore, Korea and Italy. In 2004, BITOR’s marketing subsidiaries in UK , USA and Italy initiated procedures to close their operations.

The purpose of this article is to review the business and economic rationale of the exploitation of Orinoco Belt bitumen for the production of Orimulsion, and to evaluate the future contribution to Venezuela , its people and the world environment in general offered by this non-conventional Venezuelan resource.

A perspective on the Venezuelan Extra Heavy and Bitumen hydrocarbons reserves

The cost of exploiting Venezuela ’s non-conventional hydrocarbon reserves is lower than in Canada . Venezuela ’s lower costs arise largely from more favourable geological and climatic conditions. In particular, because of the reservoir characteristics, Orinoco oil can be exploited without thermal stimulation so that less energy and heat is needed to produce it. The higher ambient temperatures also make the hydrocarbons easier to move and transport once extracted and results in less harsh working conditions at the oil fields. Also, Venezuela ’s labour and equipment costs are lower compared with those in Canada .

However, Venezuela ’s political environment increases the country’s political risk and could restrain direct foreign investment in the oil industry. Venezuela has a unique condition as the only OPEC member with major non-conventional hydrocarbon reserves; in consequence, quota treatment issues could be a factor that affects the development of these resources. Also, the need to manage and balance different sets of objectives between the Venezuela State and its National Oil Company (PDVSA), and the different International Oil Companies looking to invest in Venezuela , will define the different commercial schemes for the exploitation of Orinoco Belt.

The development of Venezuela ’s Orinoco Belt

The antecedent for the exploitation of Venezuela ’s non-conventional hydrocarbons from the Orinoco Belt can be traced to the south of Monagas State , very near to what was later known as the Cerro Negro part of the Orinoco Belt. Since 1961, Phillips Petroleum Co., Amoco, and Creole Petroleum Co (Exxon Subsidiary) developed a commercial operation for the production of the Morichal (8.5° API), Jobo (8-9° API), Pilon (13° API) and Temblador (19° API) oil fields based at the Morichal Camp. These extra-heavy oils were produced by conventional methods including alternated steam soaking and were considered as part of Venezuela ’s traditional oil reserves.

The Morichal and Jobo oils were diluted with gas-oil at the well head to reduce their high viscosity and facilitate their transport by pipeline and reach their sale specification as the commercial blend known as the Morichal Segregation with 12.5° API, that was used to obtain the “world’s best asphalt”. Pilon and Temblador were also blended to make the Pilon Segregation with 13.5° API for general refining feedstock. At present, of these two commercial crude oil segregations, PDVSA only continues the commercialisation of Pilon segregation in which all these oils are diluted to 17° API with lighter crude oils from the adjacent San Tome area and sold as blends.

After the nationalisation of the Venezuelan oil industry in 1976, PDVSA’s financial resources were very limited because of the under-investment by the concessionaries oil companies before the industry nationalisation, and the priority for PDVSA was the exploration and development of its conventional oil base. However, the steep rise in the price of oil caused by the Arab Oil Embargo and the Iranian Revolution, make attractive the development of the Orinoco Belt.

Due to the size of the area and the past involvement in different areas of the Orinoco Belt of the International Oil Companies, PDVSA divided the belt in four separate geographical areas and assigned the responsibility for the development of each one of them to one of PDVSA’s subsidiaries that operated the oil production and commercialisation activities for Venezuela’s hydrocarbons after the oil industry nationalisation: Cerro Negro to Lagoven S.A., Hamaca to Meneven S.A, Zuata to Maraven S.A. and Machete to Corpoven S.A.

In the case of the Cerro Negro area, Lagoven S.A. started the development for the production of 8.5° API Cerro Negro Bitumen with the start-up in 1984 of the Experimental Production Blocks J-20 and O-16 with nominal capacity for 25 thousand barrels per day (kb/d) of bitumen each one. These production blocks were designed using conventional technology to test different production parameters and methods (vertical wells spacing and completion, pumping units designs, steam injection schemes, etc.) to optimise the bitumen exploitation, reduce costs, and obtain knowledge to improve the attractiveness of future developments of bitumen and extra-heavy oil from the Orinoco Belt.

As in the case of Morichal and Jobo crude oils, the Cerro Negro bitumen has to be diluted with gas-oil to reduce its viscosity enough to be transported by pipeline, and it was blended and commercialised as part of the Morichal Segregation.

Not always was easy to commercialise the new production of Cerro Negro bitumen in increasing quantities because of the limited world’s refining capacity for processing the bitumen blends without additional investments in adapting the refineries to the new feedstock, and the small size of the asphalt markets that was the prime market for the Morichal segregation.

The combined effect of the diluents cost (gas-oil or other lighter crude oils), the logistics costs to import them to Morichal Camp to make the blending operation, and the limited marketability for the Morichal segregation, caused that the intrinsic valorisation for Cerro Negro bitumen was poor and made the economies of the whole operation marginal, in particular under weak oil prices.

As the bitumen require more amount of diluents compared with an equivalent amount of extra-heavy oil to reach the same viscosity, the limited availability and cost of the additional gas-oil deteriorated the economies of the commercial operation, in special after considering the oil price collapse in 1986-1988. This situation created adverse conditions for the development of Orinoco Belt bitumen under dilution schemes.

Meanwhile, during the period from 1980 to 1984, PDVSA through its Research and Development Subsidiary, Intevep S.A., jointly with British Petroleum, executed the basic research to develop a new method to reduce the high cost of transporting bitumen by pipeline. This effort resulted in a new and simple technology to produce Cerro Negro bitumen, known as Orimulsion. In this proprietary process the bitumen is mixed with water and a surfactant chemical in order to produce a stable emulsion which can be transported by pipeline and by ship in a similar way as fuel-oil.

Even better, not only the Orimulsion was easier to transport but it also can be used directly as fuel for the generation of electricity in existing thermal power plants designed for the combustion of fuel oil and/or coal, using conventional equipment with only minor modifications, with initial pricing structure competing with coal price.

After the initial test for the combustion of Orimulsion in 1986, at the facilities of Chubu Electric Power Corp (Mitsubishi Heavy Industries) in Japan, the development of Orimulsion continued through different pilot projects and tests using the existing facilities of Lagoven S.A. in Cerro Negro (Blocks J-20 and O-16) and Morichal Camp (oil processing facilities and residential camp), in order to define the operational parameters required to transform Orimulsion into a commercial product. Further work was carried out to understand and develop the mixing technologies, surfactant types and quantities, emulsion stability studies, and improved bitumen production methods.

In 1988, PDVSA decided to initiate Orimulsion commercial operations and assigned the responsibility for its development and commercialisation to a new subsidiary: Bitumenes Orinoco S.A. with the mandate to grow a profitable business.

The Blocks J-20 and O-16 and its associated hydrocarbon reserves were transferred to BITOR for the manufacturing of the new fuel. BITOR started commercial tests in selected power stations since 1988, and developed the technology and dedicated facilities for the manufacturing of Orimulsion at Morichal Camp, that resulted in the completion in 1993 of the first module for the Manufacturing and Production of Orimulsion (MPE-1) with production of 5.2 million tonnes per year (Mt/y) of Orimulsion (90 kb/d of Orimulsion), equivalent to 63 kb/d of bitumen. Its capacity was increased to 6.0 Mt/y of Orimulsion (112.5 kb/d of Orimulsion or 80 kb/d of bitumen) in 1998 to keep with the demand for the new fuel. The resulting production facilities and infrastructure are shown in Figure 1.

At the bitumen production side, BITOR introduced the commercial use of new production methods such as the massive use of well clusters, slanted and horizontal wells, cold production, progressive cavity pumps (PCP) and electro-submergible pumps (ESP), that resulted in an important cost reduction in the production costs, and the acceleration of the learning curve for new technologies that will be used to leverage the third wave of the Orinoco Belt developments: the integrated upgrading projects in the middle to late 1990s.

Recognising that Venezuela’s non-conventional hydrocarbons, whether emulsified or diluted, seemed to have too low a value in the international oil markets, either as boiler fuel or as refinery feedstock, the upgrading approach were revisited as a way to increase the commercial value of Venezuela’s extra-heavy oil and bitumen, even that many economic evaluations of different upgrading projects in the past showed poor economic returns and profitability, and in practical terms they were not financeable.

The main limitation for upgrading was the high initial capital required for the construction of large upgraders that treats the bitumen in deep coking/cracking and hydro-treating units, the energy intensive nature of the upgrading process, and the limited availability of world’s refining capacity for the upgraded crude oil.

The steady increase of oil prices and consumption from 1990 to 1997, the new technologies for production of non-conventional crude oils, and new fiscal incentives from the Venezuelan State in the form of temporal reduction in royalty payments and the application of the normal corporate income tax rate instead of the oil rate, made attractive the development of upgrade projects to process and convert the Orinoco Belt hydrocarbons from approximately 7-9° API to lighter, sweeter upgraded crude with 14-30° API, depending on the degree of upgrading for each individual project.

In 1991, PDVSA’s operating subsidiaries began negotiations with foreign oil companies to form strategic associations for exploiting the Orinoco Belt resulting in the four Venezuelan upgrading projects: Cerro Negro, Petrozuata, Sincor and Hamaca. By 2003, these projects were producing about 500 kb/d of sweet upgraded crude oil, expected to increase to 640 kb/d with the planned completion of the Hamaca upgrader by the end of 2004.

The development of Orimulsion

Orimulsion is an emulsion of approximately 70% natural Cerro Negro bitumen 8.5° API suspended in 30% fresh water by means of mechanical energy and the addition of less than 1% alcohol-based surfactants (emulsifiers) that allow the bitumen droplets to remain suspended in a stable mode. This product can be easily handled at room temperature and with standard equipment. Furthermore, the presence of water improves the combustion characteristics of the natural bitumen.

Orimulsion, positioned as a new low cost fuel for electricity generation in existing or new oil or coal fired plants, has many attractive characteristics such as the fact that it can be used in power stations designed to run on coal or heavy fuel oil with small modifications, its price is competitive with internationally traded coal, the known reserves of bitumen are very large, and it is easy to ignite and has good combustion characteristics with emissions easily controllable with existing commercial air pollution control technology to comply with environmental regulations worldwide.

The use of combustion controls, such as low NOx burners (LNB) and Reburn, and post combustion control technology, such as selective catalytic reduction (SCR), have been demonstrated as viable control techniques for Orimulsion. While direct application of these technologies is project specific, typical emission levels for Orimulsion combustion, with state-of-the art technology, are shown in Figure 2.

Emissions from power plants using Orimulsion are very similar to, or lower than, those for the most modern coal-fired power plants that have applied Best Available Control Technology (BACT) and are much lower than uncontrolled oil-fired plants. The uncontrolled NOx emissions from Orimulsion are low even when compared to natural gas.

The CO2 emissions from Orimulsion are 20% lower when compared to coal. Moreover, since Orimulsion is a liquid fuel, there are no emissions associated with fuel handling, unlike coal. Also, there are considerably lower amounts of ash (50 times less) using Orimulsion than using coal.

Orimulsion has been used as a commercial boiler fuel in power plants worldwide in such countries as UK , Canada , Denmark , Japan , Italy , Lithuania , China and Barbados , since the Commercial combustion trials initiated in 1986. Negotiations also are under way with electric utilities in Brazil , Costa Rica , Denmark , Finland , Germany , Guatemala , Northern Ireland , Philippines , Singapore , South Korea , Taiwan , Thailand and Turkey .

As Orimulsion production from the existing facility MPE-1 were completely sold, in December 2001, the Venezuelan National Assembly approved a joint venture between BITOR and China National Petroleum Corporation (CNPC) named Orifuels Sinoven S.A. (Sinovensa) to develop a new module for the Manufacturing and Production of Orimulsion (MPE-2) with production of 6.0 million tonnes of Orimulsion per year to supply the Chinese market.

The new company is investing US $330 million and plan start Orimulsion production by the end of 2005. On November 26, 2003 , CNPC began constructing China ’s first Orimulsion-fired power plant located in Zhanjiang city in southern China ’s Guandong province.

In addition to being used in conventional power plants using steam turbines, Orimulsion can be used in diesel engines for power generation, in cement plants, as a feedstock for Integrated Gasification Combined Cycle and as a "reburning" fuel (a method of reducing NOx by staging combustion in the boiler).

The Market for Orimulsion: The Electric Sector

The evolution of the electricity markets in the last 30 years has been affected by serious concerns about the security of electricity supply and how to maintain and improve the electric systems for coping with fuel supply disruptions such as the Arab Oil Embargo in 1973.

The electricity markets began to be reformed around the world. The key OECD Member countries have already introduced competition into their electricity systems and are increasingly allowing market forces to play a role in the development and operation of electricity supply in search of greater economic efficiency. The goal of these changes is to reduce electricity prices to consumers by reducing the costs of inputs to electricity generation and supply

The changes in energy policy for many governments throughout the OECD, directed at reduce the exposure of their electricity industries to imported oil, made that the strong investment in electricity since 1974 have resulted in the increase in the share of gas-fired capacity mostly at the expense of oil-fired capacity, while nuclear and coal have showed a modest increase and hydro capacity has remained stable. The change in the generation mix has been significant with gas as the fuel of commercial choice for new capacity.

By 1990, the potential market identified for the use of Orimulsion was of 55 Mt/y of Orimulsion (950 kb/d of Orimulsion), equivalent to 670 kb/d of bitumen, focussed in the main OECD countries. This demand was impressive for a new fuel, but was infinitesimal compared with world’s electricity generation. However, at local level the new fuel disrupted commercial interests within the existing stakeholders of national electric industries and their reaction affected the commercial penetration of Orimulsion in some markets, in particular UK and USA .

The use of Orimulsion during its commercial introduction was targeted to the ageing park of oil or coal fired plants that were unused or in peak service, but with the competitive price of Orimulsion can generate electricity at low cost and we able to compete in base load against the existing generating pool.

After more than 18 years of successful experience in the use of Orimulsion by blue chip power companies, and the continuous technological improvement to maintain the compliance with the newest environmental legislation, the signature of Orimulsion supply contracts for new electric generating capacity to be built in China, Singapore, South Korea and central America, competing against fuel oil, gas and coal, signalled the consolidation and the new expansion for the Orimulsion market.

Also an important milestone in the development of Orimulsion was reached in 2001 when the efforts of PDVSA and BITOR to bring the benefits of the advance technology and low cost of Orimulsion to the Venezuela population, resulted in the inclusion of Orimulsion in the Venezuelan Electricity Plan to supply an important part of the forecasted increase in the demand for electricity at low cost.

The Electricity Plan contemplates not only the conversion to Orimulsion of existing oil and gas fired plants but also the construction of new capacity specially designed for Orimulsion. The use of Orimulsion has strong economic incentives for Venezuela, as about 80 kb/d of fuel oil previously burned for electricity generation in Venezuela will be exported to capture the significant differential in price between the Venezuela’s internal fuel market and world’s prices, and also 140 million cubic feet per day of natural gas will be used in industrial activities with more value added instead of electricity generation at subsidised prices.

The construction of a large electricity generating complex in the Orinoco Belt, just on top of the bitumen reservoir, brings an appreciable and structural reduction in generating costs as the Orimulsion will be manufactured “Just in Time” next to the point of use, with simpler logistics arrangements and requiring smaller safety stock of fuel than when the fuel comes from distant sources.

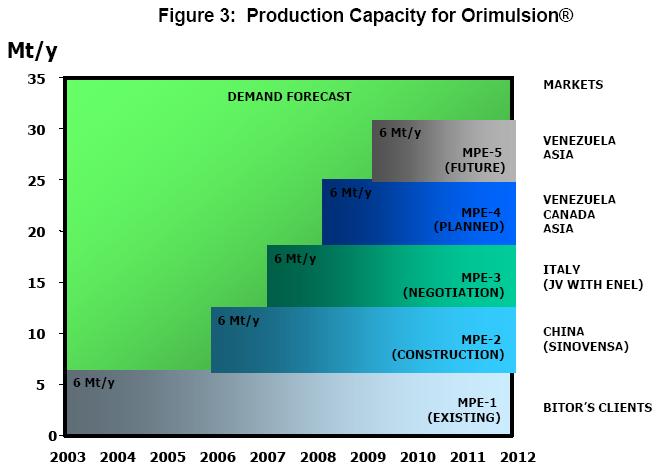

The demand forecasts for Orimulsion are strong, PDVSA’s previous plans for Orimulsion contemplated the firm development of at least three new production modules (MPE-2/3/4) to increase total Orimulsion production up to 25 Mt/y (320 kb/d of bitumen) from a potential demand for Orimulsion of more than 35 Mt/y as seen in Figure 3. Just in Venezuela the potential opportunities identified call for the consumption of about 12 Mt/y of Orimulsion.

The economies of Orimulsion

For the construction of a module for Manufacturing and Production of Orimulsion, with production capacity of 6.0 Mt/y of Orimulsion during 30 years, the total investment required is about US$ 630 million of which 55% accounts for the initial investment in the emulsifying plant, production facilities and bitumen wells. The rest of the investment will be distributed evenly during the life of the project to drill new bitumen wells as required to maintain constant the bitumen production level and compensate for reservoir depletion.

The financial values obtained from the economic appraisal for a new Orimulsion Module are very attractive and compare very favourable with the financial values for an upgrade project as both developments have a similar internal rate of return in the region of 12-15%.

As the pricing structure for Orimulsion migrates from the initial near-parity with coal prices that characterised its introductory phase to world’s markets towards a much higher price that fully reflects the inter-fuel competition at the user specific location, the new sale contracts signed recently already make a significant improvement in the economies of Orimulsion.

Also, there is an appreciable upside for Orimulsion in the electricity generation business as the profit margin obtained with the sale of electricity is much higher than the margin from the sale of fuel. There is considerable room to capture some of this value for the fuel seller if some degree of vertical integration with the electricity generator occurs, taking equity participation in the electricity generating assets as consideration for the economic benefits that the reduction of generating costs brings to the plant owner. Of course, the additional income that comes from the opportunity to participate in the sale of electricity as opposed to just sell fuel also brings additional risk exposure that have to be managed.

From the point of view of Venezuela and its people, the income from the sale of Orimulsion during the next 30 years will have a positive effect in the economic development of Venezuela . As shown in Figure 4, more than US$ 25 billion will be generated by Orimulsion sales, and more than 80% of them will remain in Venezuela to be reinvested within the country and stimulate the growth of the economy.

The portfolio approach to develop the Orinoco Belt hydrocarbons

PDVSA recognised from the beginning, that the only way to ensure the maximum value for Venezuela from the Orinoco Belt reserves was the use of Portfolio Optimisation techniques, to balance the development of the reserves within the technological choices available at different times, and arrive to the mix that maximises the efficiency and value of the reserves and minimizes its risks under different constraint conditions and changing business conditions.

The historic development of the Orinoco Belt has been affected by different constrains such as:

- Which technological solution requires higher investments per unit of production, as PDVSA has a limited amount of capital to invest in new developments because of pressure to deliver increasing cash flows to its shareholder, the Venezuelan State .

- The interest of International Oil Companies or other types of investors to associate with PDVSA and invest in the Orinoco Belt.

- The technology attributes and the related potential for cost decreases as the technologies evolve.

- OPEC quota.

- The attributes of the targeted markets and its potential changes in the future.

- The resistance to energy supply changes as they often require significant investment by energy producers and consumers.

- The limited availability of refining outlets for blended and upgrade oils as refiners need to invest in special modifications to process them.

- The subsidies by different governments (energy producers and consumers) to give competitive advantage of some technologies against others.

- The potential for improved energy efficiency in the different energy markets, such as the implications of the introduction of the hybrid car in the consumption of oil for transportation.

- Environmental legislation, i.e. Kyoto Protocol.

As described in this article, the exploitation of the Orinoco Belt has been executed through three very distinctive technological waves, namely Dilution, Orimulsion and Upgrading, with different sets of technological and financial attributes. Now, Orimulsion and Upgrading coexist and complement each other to give important economic benefits to Venezuela as proven methods of monetising the Orinoco Belt within the perceived window of opportunity for Oil.

The Upgrading option is targeted to the Transportation sector as the synthetic oil will be used as feedstock of refineries to produce mainly gasoline and in less degree fuels for other industrial activities, and will compete in oil markets characterized by volatile prices and high risk profile.

In contrast, Orimulsion is targeted to the Electric sector as part of the fuel mix of electricity generating portfolios in which in general the price volatility is low so that the electricity fuel price is stable and lower that oils markets, the risks moderate, hence the returns from Orimulsion are not expected to be as high as in the oil business. However, the stable price reduces the uncertainty at the moment of budgeting based on Orimulsion income.

The value contribution from Orimulsion, defined as the profits to Venezuelan State per barrel of bitumen produced after operating and capital costs, is lower than the value from upgraded oil. Furthermore, this lower value is expected because of the lower profit margins in the electricity markets.

However, this difference in value is decreasing as the competitiveness of Orimulsion against other fuels improves as proven with the latest sales contracts signed, and opportunities for vertical integration with the electric markets are materialised so that the contribution from Orimulsion could converge to near-parity with upgraded oil. It is important to note that Orimulsion contributes to Venezuela ’s Inland Revenue (Income tax and Royalty) almost the same percentage of profits than the upgrading associations as seen in Figure 5.

The development of Orimulsion brings another significant but subtler implications that change and improve the competitiveness of the Venezuelan oil industry:

- Orimulsion as the first and successful entry of PDVSA in the electric sector, which require completely distinct skills set compared with the oil business, anticipates the future diversification of PDVSA’s activities into this sector.

- Orimulsion is the first Venezuelan hydrocarbon that is economically sold in Asia, a non-traditional outlet for Venezuelan oils because of the high shipping cost from Venezuela to Asian ports, and the wide availability of Arabian Golf oils in that region. The piggy-back of Venezuelan oil shipments in the same tanker carrying Orimulsion allows them to penetrate the Asian markets.

- There are geopolitical implications for Venezuela as the producer of Orimulsion and its potential as enabler of electricity at low cost in developing countries, as these countries usually have inefficient electricity generation and distribution systems, with greater room for quality of life improvement than the developed economies that already enjoy low cost electricity.

The future of Orimulsion

There is not doubt that Orimulsion is a unique Venezuelan technological solution for the massive exploitation of the Orinoco belt, implemented commercially in a moment when there was not other economical option for the profitable exploitation of Venezuela ’s non-conventional hydrocarbons.

The Orimulsion technology is far from complete. BITOR, jointly with Intevep, was executing an aggressive plan of research and development to further improve Orimulsion in such areas as reduction of sulphur content in Orimulsion, reduction of water content in Orimulsion to increase the caloric value and reduce transport costs, and surfactant optimisation, among others.

After more than 18 years of the new fuel making in-roads in world’s markets, the projections for the expansion in the use of Orimulsion is very promising and have the potential to change radically the energy offer from Venezuela .

Some of the envisioned changes for the future of Orimulsion are:

- The integration of BITOR’s knowledge of the electric sector with other PDVSA’s fuels for this market to create a new company with multi-fuel capability and expert knowledge to enter the electricity generation business world wide.

- The Manufacturing of Orimulsion in other countries with bitumen reserves either as joint ventures or licensing the technology. This will create the possibility of Orimulsion blending to adapt the fuel to the specific conditions at the power plants and optimise their output.

- The use of Orimulsion as feedstock of gasification processes to obtain syngas to supply IGCC projects or even petrochemical plants.

- As the combustion of Orimulsion produces 20% less CO 2 compared with coal, there is significant value to be capture by Orimulsion as an enabler to reduce the CO 2 from coal fired power plants either as tax credits or CO 2 allowances trading under the Kyoto Protocol to reduce greenhouse gas emissions.

The only possibly conclusion is that Orimulsion represents a brilliant opportunity for Venezuela to develop and profit from the huge reserves of bitumen in the Orinoco Belt, developing a new and profitable market for the Venezuelan hydrocarbons as the electricity sector will account for more than 70% of world’s total energy investment in the next 30 years and growth. If Venezuela suspends the development of Orimulsion, as has been recently announced, a lifetime opportunity to improve the quality of life of the Venezuelans will be wasted. However, in the long term the global energy requirements are so immense, that Orimulsion is likely to return to the scene.

Bibliography

Bitumenes Orinoco , S.A. , Marruffo F., Chirinos M., Sarmiento W., Hernandez E., “Orimulsion® A Clean and Abundant Energy Source”, Caracas .

Energy Intelligence Group, Knapp D., “Update on Competitiveness of Non-Conventional Oil”, Second Joint IEA/OPEC Workshop on Oil Investment Prospects, Paris , 28 April, 2004 .

Fact Sheet ORIMULSION®: Air Emissions Overview, March 25, 2003 . Bitor America Corporation

Guerrero S., Pacheco L., Layrisse I. , “The Optimal Use of Venezuela’s Hydrocarbon Reserves: A Critical Analysis”, Middle East Economic Survey 47:24, 14 June 2004

EIA, Venezuela Country Analysis Brief, June 2004

IEA, World Energy Investment Outlook - 2003 / Insights, Paris , November 2003.

IEA, Awerbuch S., Berger M., “Report Number EET/2003/03: Applying Portfolio Theory to EU Electricity Planning and Policy-Making”, Paris , February 2003.

IEA, Ocaña C., Hariton A., “Security of Supply in Electricity Markets: Evidence and Policy Issues”, Paris , 2002.

Santos R., Harman K., “Portfolio optimization techniques help allocate capital”, Oil & Gas Journal, August 9, 1999 .

World Energy Council, Bauquis P., “What Future for Extra Heavy Oil and Bitumen: The Orinoco Case”, 17 th WEC Congress , USA , 13-18 September 1998.

The author

Carlos Rodriguez is the former Group Finance Manager of Bitumenes Orinoco , S.A. He has been involved in the development of the Orinoco Belt working for PDVSA’s subsidiaries for over 22 years in Oilfield Development, Corporate Planning and Strategy, and Finance. He holds a BEng in Mechanical Engineering from Universidad Simon Bolivar, Caracas , Venezuela , and an MSc in Logistics and Supply Chain Management from Cranfield University , UK . The author can be contacted by email via carlos_rodriguez_fbo@yahoo.co.uk.

send this article to a friend >>